Diploma in Accounting

Watch your job prospects soar

Getting a Diploma in Accounting online that NZ employers recognise is a great way to add value to your CV. The Diploma in Accounting includes learning across basic, advanced, management, and taxation accounting – plus, you will enhance your task management skills and get ready to complete full financial statements. This diploma comes with graduate membership to the Association of Accounting Technicians (AAT) and the Institute of Public Accountants (IPA). Enrol now to enhance your accounting skills and pursue a career in accounting, finance or business.Or Call 0800 342 829

100% Online Delivery

Get instant access

Plus receive unlimited tutor support via phone & email from experienced professionals.

Course Duration

Get qualified & Earn More

Improve your accounting career

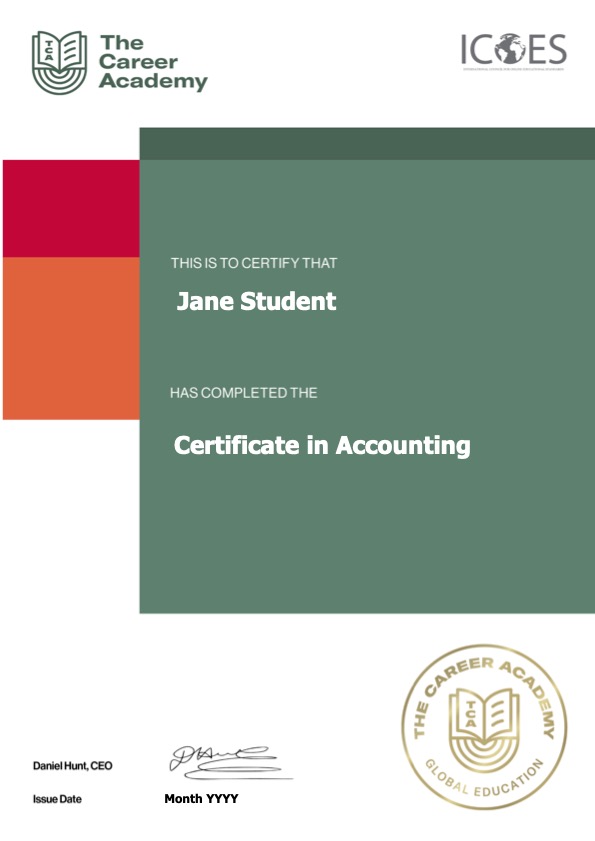

Be awarded with an industry-recognised certificate of achievement on completion of this course.

Investment & Payment

INDUSTRY

ACCREDITED

I FELT LIKE THERE WAS A CLEAR OUTCOME WITH WHAT I COULD DO WITH THE CAREER ACADEMY'S COURSES!

Almost immediately, it was the AAT Accounting Technician Pathway Program that caught her eye. ‘It offered me the accounting theory that I needed, with the option to add “Accounting Technician” status to my name, along with applying all my theoretical knowledge into practice through the use of accounting software such as Xero. It was also a lot more value for money than other courses I had researched.‘

CAREER BENEFITS

- Understand issues in income determination & asset valuation

- Learn about performance measurement & CVP Analysis

- Get an advanced qualification to build on the Certificate of Accounting

- Receive student membership to AAT on enrolment

- Access industry connections, support & guidance – plus graduate membership to IPA

- Attain Accounting Technician status on completion

- Gain FREE access to the CCH Wheelers eLibrary with over 50 popular textbooks, including the Practical Accounting Guide

COURSE CONTENTS

- Access and save excel templates.

- How to open an Excel file and save this using a specific name.

- Identify and apply formulas and functions to calculate data.

- How to add content, such as pictures and charts, to spreadsheets.

- Apply filters to spreadsheet data.

- How to sort and manipulate spreadsheet data.

- Apply a range of formatting styles to spreadsheet data.

- Accounting and Business

- Determining Profit

- Issues in Income Determination & Asset Valuation

- Accounting Principles Assessment

- Tracking Cash & Controlling Assets

- Internal Decision Making

- Analysing Financial Reports

- Financial Reporting Framework

- Advanced Accounting Principles Assessment

- Cost Classification

- Costing Methods

- Product & Process Costing

- Standard Costs & Variance Analysis

- Management Accounting Assessment

- Activity Based Costing

- Budgeting & CVP Analysis

- Performance Management & Measurement

- Inventory Management & Planning

- Advanced Management Accounting Assessment

- Fundamentals of Income Tax

- Understanding GST

- Depreciation

- Certificate in Xero Assessment

- Advanced Certificate in Xero Assessment

- SPFR Framework For For-Profit Entities Part 1

- SPFR Framework For For-Profit Entities Part 2

- SPFR Framework For For-Profit Entities Part 3

- Verification, Completeness & Justification

- Accounting for a Full Year Case Study

- Looking Forward Case Study

- Accounting Practices Assessment

- Introduction to the Accounting Profession

- Ethics and Standards

- Professional Education

- Practice Essentials

- Practice Security

- People and Processes

- Growing your Business

- Digital Business

- Sustaining Your Business

- Assessment

Enjoy fantastic FREE benefits when you become a Certified Accounting Technician and member of IPA

- IPA delivers value to members through a suite of helpful tools, resources, and benefits

- FREE CPD/educational webinars, news and updates and discounts to IPA events

- Receive unique opportunities around networking with accountants, bookkeepers and tax agents.

- Joining our community of like-minded accountants and bookkeeping professionals will keep you informed and updated, assisting you to achieve your future goals.

Flexible Payment Options

POPULAR

PAY IN FULL AND SAVE $500

Discounted price

Pay your course fees upfront and benefit from a $500 discount, with a 7 day money-back guarantee.

- Save $500 on course fees

- Best value option

- No deposit

- No credit checks

- Pay weekly, fortnightly, or monthly

of Achievement

Opportunities

Support Services

Success Stories

Why The Career Academy?

We’re an internationally recognised online education provider, who partners with industry to deliver you the latest and most up to date content. We have over 15 years experience in online education and help change the lives of over 20,000 students every single year.

- Upskill and be awarded with a certificate of achievement to help you reach your potential & earn more.

- Flexible online learning so you can study whenever and wherever you want.

- Get free access to the career centre who will review and improve your CV to help you succeed.

- 83% of our graduates say our qualifications improved their ability to get a new job or promotion.

Receive unlimited tutor support

Our professional tutors at The Career Academy are industry experts who are passionate about helping students succeed. They’re committed to providing exceptional online course support and personal tutoring to help you succeed. Throughout your course, you’ll receive unlimited tutor support via phone and email.

After graduating from The University of Auckland, Bhavik came to us as one of our resident Accounting tutors where he amazes both his students and colleagues with his huge range of knowledge. Bhavik has been with us for two years and we’re still trying to find a topic that he’s not an expert in. So far we know he’s a pro at web development, IT, simulation racing, and guitar, so who knows what other talents he’s hiding from us.

While tutoring, Bhavik loves that every student is unique which means he can tailor his tutoring style to each one. He says its especially rewarding when he sees a less confident student develop over the course of their learning.

Tracey is a people person with impressive juggling skills. Like many of The Career Academy’s students, she’s a working mum balancing her job and her family.

In her previous role as an office manager at one of Lion Nathan’s Auckland establishments for seven years, she was responsible for all manner of financial duties (incl. payroll, and accounts payable & receivable.) She later backed up these skills with a Bachelor of Business from Massey.

Although she’s a proficient “number cruncher” it’s working with her students which Tracey enjoys the most. Seeing when a student really “gets it,” when their confidence soars or when they’re able to secure that new role – these are things that she loves.

Ryan is an Accounting Tutor at The Career Academy with a Bachelors’s in Accounting and Economics from the Auckland University of Technology, New Zealand. Ryan enjoys inspiring students and loves passing on his knowledge of Accounting. Many years of education have taught him that every student learns differently, which puts him in an excellent position to tailor his teaching for an exciting student learning experience.

Besides Accounting, Ryan loves traveling and watching Premier League football, as he was a football player in his school days. Ryan loves helping people achieve their goals and success in their career.

Anna is a Tutor at The Career Academy and has a strong background in hands-on accounting and bookkeeping after several years working in this area. One of her favourite quotes is, “Education is the difference between wishing you could help other people and being able to help them”- Russell M Nelson. Anna feels that education is the foundation of growth, and she is committed to helping students, whatever their abilities, achieve their learning goals.

Anna graduated from Auckland University of Technology with a Bachelors in Business, majoring in Accounting & International Business, and she enjoys using her experience, together with her passion for learning, to be a positive influence on our students.

When Anna isn’t helping students, you can find her with her family and in her garden.

Md brings over 10 years of diverse experience spanning aviation, HR, retail, and education to the world of finance and accounting. With notable positions at esteemed organizations such as Biman Bangladesh Airlines, Impact College, and Tech Mahindra, he has honed his expertise.

Md holds MBA degrees from both the University of Chester and the University of Dhaka, enabling him to take a strategic approach to teaching accounting and finance concepts. His proficiency in financial analysis and forecasting ensures that he delivers dynamic and practical lessons.

Prior to his role at The Career Academy, Md served as the Financial Accounts Manager at Impact College, where he oversaw critical functions like internal audits and budgeting. He integrates this hands-on experience into his tutoring, bridging the gap between theory and real-world scenarios.

As a mentor, Md guides students through intricate topics such as bookkeeping processes, VAT compliance, payroll management, financial,and management reporting, guaranteeing comprehensive learning. His systematic teaching style and exceptional communication skills make complex financial subjects more accessible.

Driven by his passion for inspiring students, Md promises an enriching and value-driven learning journey. With his multifaceted expertise, he offers well-rounded support to learners.

I obtained a Bachelor of Business Studies majoring in Accounting from Waikato Institute of Technology. During my time studying, I mentored several international students in a range of topics including commercial law, marketing, accounting & finance. Not only did this give me lots of energy watching my students grow, it also deepened my understanding of these topics as well as how to relate to people.

It is no surprise that I came to The Career Academy – with a teacher for a mother, it’s just in my blood.

Outside of work, I like to relax by playing football with my teenage sons, dance to Baila music, read, or cook delicious meals with my wife.

Dedicated professional with a passion for continuous learning and adaptability. Excels in leveraging diverse skills to tackle challenges and contribute to collaborative team environments. Committed to achieving goals and driving success through innovation and effective communication.

of Achievement

Be awarded with an industry recognised certificate

Upon successful completion of your course, you’ll be presented with a Professional Certificate by The Career Academy. This an industry recognised certificate which will go a long way to helping you get a new job or promotion. You’ll also be given access to our exclusive Career Centre and be eligible for a free CV Review.

Opportunities

Career Opportunities

The Career Academy’s Accounting program opens doors to significant roles in both small businesses and large multinational companies. Our focus is on making you career-ready, preparing you for key positions such as:

- Accountant

- Auditor

- Bookkeeper

- Accounting Technician

- Taxation Specialist

Career Projections

Accountants are listed on Immigration New Zealand’s regional skill shortage list, indicating that the Government is actively encouraging skilled accountants from overseas to work in New Zealand. This means that:

- There is a strong demand for analysts who are capable of understanding and interpreting financial data to aid business decision-making.

- Common employment for accountants includes accounting firms, as well as diverse sectors such as mining, government, education, and banking.

Sources: Seek, Careers New Zealand

Support Services

The Career Centre

The Career Academy is committed to helping you on your pathway to success. We believe by utilising The Career Centre’s resources and connections, you’ll gain confidence and the networks you need to get a new job or promotion.

Once enrolled with us, you will get instant access to our Career Centre and benefit from:

- Access to CV Templates – freshen your current CV with one of our professional templates

- A free personalised CV review – we’ll review and provide feedback on your CV to ensure it stands out from the crowd

- Useful job tips and resources – we’ll outline a clear five step job success process for you to follow

- Help getting ready for interviews – will give you tips & tricks on how to succeed

Success Stories

A NEW ODYSSEY IN ACCOUNTING

The Greeks are no strangers to an Odyssey, but George started one of his own when he uprooted from Greece and moved his family halfway across the world in 2012. “I think the transition has been easier for our boys than for my wife and I.” he says. “They’re younger and they’re surrounded by English-speakers at school every day. They often correct our English – but that’s good, it helps us improve even more!”

With more than 20 years professional experience as a Dentist, George found that his Greek qualifications weren’t recognized globally, and that re-qualifying would be like pulling teeth – literally. Instead of dealing with the arduous, lengthy, and expensive process of re-qualifying, George decided to take his first tentative steps in a new career.

At first, George was considering a career in tourism, but considering that “I’m not in my twenties anymore,” and that he had a proven record of business acumen, he instead opted to begin a career in accountancy. Attending polytechnic was not appealing; it was more costly than online learning, and would seriously cut into the hours where George could be earning an income.

So, he searched online and found The Career Academy’s Certificate in Accounting. From his first phone call, it was obvious George had made the right choice. Amy (his one-on-one student advisor) was patient and kind on the telephone, carefully answering his questions, explaining how online learning would look (you can see it for yourself here), and letting him know he’d be supported every step of the way.

Studying around his temporary job at a fast-food restaurant, George successfully completed the 140 hour course in just seven weeks. George’s online experience at The Career Academy was so good, he decided to take a second course, this time in the Advanced Certificate in Accounting, which expands on the core concepts he learned while studying the Certificate. Ultimately, George has his sights set on becoming an Accounting Technician, and he likely won’t be far away with the certificate’s endorsement by the International Association of Accounting Professionals. The course also includes up to six months access to MYOB and allows students to receive the official Xero Advisor Certification, so George will be well equipped with the tools of the trade.

George’s Odyssey is far from over, but if you want to follow in his footsteps check out the Certificate or Advanced Certificate in Accounting and you can get started immediately.

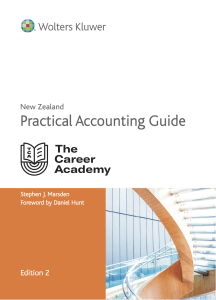

Get access to the CCH Practical Accounting Guide valued at $126!

This practical guide covers a range of Accounting, Bookkeeping and taxation issues that Accountants need to be aware of when dealing with their business or clients. You’ll get instant access to this eBook once you enrol, plus many more free eBooks to help you study.

Upgrade & Save

- Enjoy increased earning potential

- Move your career forward

- Attain Certified Accounting Technican Status (CAT)

Certificate in Accounting

Diploma in Accounting

Get all the info you need

- Course duration, qualifications and module details

- Pricing and payment options

- Compare other related courses

- Receive a free course consultation

Prefer a call? Talk to our friendly staff on 0800 342 829

Frequently

Asked

Questions

There are no entry requirements or prerequisites to enrol on this course. You can enrol online directly by clicking on “Enrol Now” and following the prompts. Alternatively, you can enrol over the phone with our friendly student advisors – call 0800 342 829 or email them at info@careeracademy.co.nz

This course costs $1,895.00 + GST or only $25 per week on a no-deposit, interest-free payment plan. Click here to get started now.

Some students pathway onto Bachelor or Degree courses if they want to secure higher level roles in the future (i.e. CFO level). Unitec, for example, has approved credit recognition for this Diploma course into their Bachelor of Business (specifically courses ACTY5200 and ACTY5206).

Yes, you can apply for RPL for this if you already hold other accounting qualifications or have other accounting experience.

This course takes approximately 300 hours, and you’ll have up to 12 months to complete. Study in your own time, at your own pace. Most of The Career Academy courses are designed so that you do one module a week, but if life gets busy, you can apply for a course extension if you need more time.

Upon completing this course, you could obtain work as an Accountant, Bookkeeper, Accounting Technician, Senior Finance Officer, Payroll Manager, Tax Agent or Management Accountant.

Contact a friendly student advisor on 0800 342 829 to learn about potential career outcomes and where our courses could take you. Employers often approach The Career Academy looking for students and advertise jobs in our Career Centre, which you can access once enrolled. You’ll also receive a FREE CV review.

Your course is delivered through our online learning platform, which you can access from any web browser 24/7 to work whenever and wherever you want. You can also interact with your tutors and other students within the learning environment. Online learning allows you to make the best use of your time and puts all the necessary resources at your fingertips. There are no set course start dates; you can start whenever you are ready, and your tutors and student services will check in on your progress and help you every step of the way.

Watch this video to see how online learning works:

Absolutely! You’ve got a 7 day cooling off period (or trial period) at the start of your course. Take that time to look through all your learning material and get a feel for online learning. If you decide the course isn’t for you within the trial period, you’ll get a full money back guarantee*.

If you’re eager to enhance your practical accounting skills and pursue a career in accounting, finance or business, then the Diploma in Accounting is a must. This course is also an excellent skill builder for students who run their own businesses.

Absolutely! Students who have complete this Program, including the CAT certification component with IPA, will also be eligible for 3 exemptions from the ACCA Qualification:

- Business & Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)