Accounting Technician Pathway for Bookkeepers

Start where you are and build upwards

Discover how far you can go with hands-on accounting training. Accelerate your career or manage your business with a pathway leading to AAT Accounting Technician status. This accounting technician course accelerates your learning by starting with the Certificate in Bookkeeping, and moving on to the Diploma in Accounting, after which you will attain AAT status with the Association of Accounting Technicians. Understand financial statements, basic, advanced, taxation, and management accounting – and learn to manage tasks effectively. Explore Xero for bookkeeping, and become a student member of the AAT with our accounting technician course. Enrol to learn and grow.Or Call 0800 342 829

100% Online Delivery

Get instant access

Plus receive unlimited tutor support via phone & email from experienced professionals.

Course Duration

Get qualified & Earn More

Kickstart your Bookkeeping Career

Be awarded with an industry recognised certificate of achievement on completion of this course.

Investment & Payment

INDUSTRY

RECOGNISED

I FELT LIKE THERE WAS A CLEAR OUTCOME WITH WHAT I COULD DO WITH THE CAREER ACADEMY'S COURSES!

Almost immediately, it was the AAT Accounting Technician Pathway Program that caught her eye. ‘It offered me the accounting theory that I needed, with the option to add “Accounting Technician” status to my name, along with applying all my theoretical knowledge into practice through the use of accounting software such as Xero. It was also a lot more value for money than other courses I had researched.‘

CAREER BENEFITS

- Understand the purpose of accounting

- Gain advanced accounting software skills

- Get ahead with an AAT Approved Training Provider

- Bolster your CV with this industry-recognised accounting course

- Let employers know you mean business

- Student Membership to the Association of Accounting Technicians

- Gain Graduate Membership to IPA

COURSE CONTENTS

This qualification comprises three components:

- Accounting and Bookkeeping Fundamentals

- General Journal

- General Ledger & the Trial Balance

- Depreciation

- Adjusting Entries

- Financial Statements

- Understanding GST

- Employment Law & Introduction to Payroll

- Fringe Benefit Tax

- Fundamentals of Income Tax

- Accounting with MYOB AccountRight

- Accounting with Xero

- Budgeting, Forecasting and Cashflow Management

- Bookkeeping using Microsoft Excel

- Accounting with Excel

- Accounting Principles

- Advanced Accounting Principles

- Management Accounting

- Advanced Management Accounting

- Taxation

- Accounting with Xero

- Advanced Xero

- Accounting Practices

- Introduction to the Accounting Profession

- Ethics and Standards

- Professional Education

- Practice Essentials

- Practice Security

- People and Processes

- Growing your Business

- Digital Business

- Sustaining Your Business

- Assessment

Enjoy fantastic FREE benefits when you become a Certified Accounting Technician and member of IPA

- IPA delivers value to members through a suite of helpful tools, resources, and benefits

- FREE CPD/educational webinars, news and updates and discounts to IPA events

- Receive unique opportunities around networking with accountants, bookkeepers and tax agents.

- Joining our community of like-minded accountants and bookkeeping professionals will keep you informed and updated, assisting you to achieve your future goals.

Flexible Payment Options

POPULAR

PAY IN FULL AND SAVE $545

Discounted price

Pay your course fees upfront and benefit from a $545 discount, with a 7 day money-back guarantee.

- Save $545 on course fees

- Best value option

- No deposit

- No credit checks

- Pay weekly, fortnightly, or monthly

Opportunities

Why The Career Academy?

We’re an internationally recognised online education provider, who partners with industry to deliver you the latest and most up to date content. We have over 15 years experience in online education and help change the lives of over 20,000 students every single year.

- Upskill and be awarded with a certificate of achievement to help you reach your potential & earn more.

- Flexible online learning so you can study whenever and wherever you want.

- Get free access to the career centre who will review and improve your CV to help you succeed.

- 83% of our graduates say our qualifications improved their ability to get a new job or promotion.

Receive unlimited tutor support

Our professional tutors at The Career Academy are industry experts who are passionate about helping students succeed. They’re committed to providing exceptional online course support and personal tutoring to help you succeed. Throughout your course, you’ll receive unlimited tutor support via phone and email.

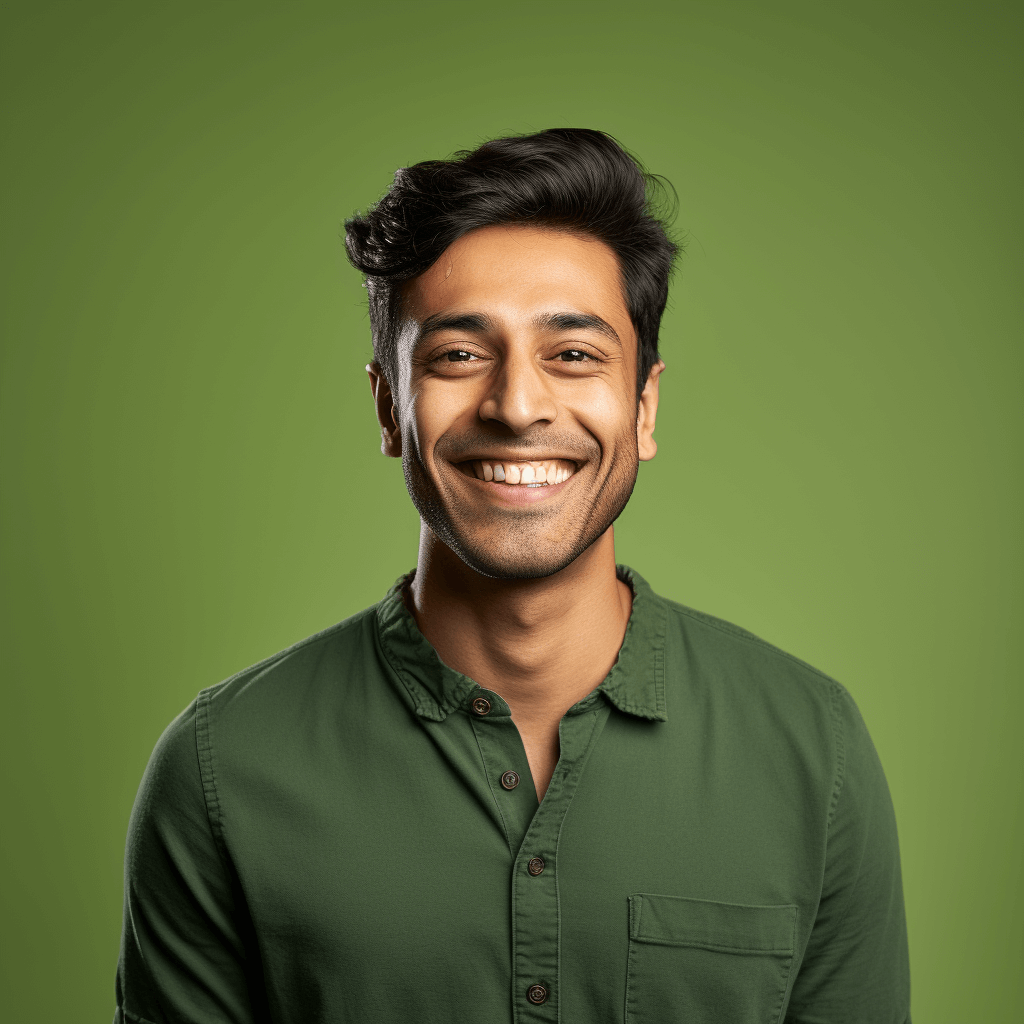

After graduating from The University of Auckland, Bhavik came to us as one of our resident Accounting tutors where he amazes both his students and colleagues with his huge range of knowledge. Bhavik has been with us for two years and we’re still trying to find a topic that he’s not an expert in. So far we know he’s a pro at web development, IT, simulation racing, and guitar, so who knows what other talents he’s hiding from us.

While tutoring, Bhavik loves that every student is unique which means he can tailor his tutoring style to each one. He says its especially rewarding when he sees a less confident student develop over the course of their learning.

Tracey is a people person with impressive juggling skills. Like many of The Career Academy’s students, she’s a working mum balancing her job and her family.

In her previous role as an office manager at one of Lion Nathan’s Auckland establishments for seven years, she was responsible for all manner of financial duties (incl. payroll, and accounts payable & receivable.) She later backed up these skills with a Bachelor of Business from Massey.

Although she’s a proficient “number cruncher” it’s working with her students which Tracey enjoys the most. Seeing when a student really “gets it,” when their confidence soars or when they’re able to secure that new role – these are things that she loves.

Ryan is an Accounting Tutor at The Career Academy with a Bachelors’s in Accounting and Economics from the Auckland University of Technology, New Zealand. Ryan enjoys inspiring students and loves passing on his knowledge of Accounting. Many years of education have taught him that every student learns differently, which puts him in an excellent position to tailor his teaching for an exciting student learning experience.

Besides Accounting, Ryan loves traveling and watching Premier League football, as he was a football player in his school days. Ryan loves helping people achieve their goals and success in their career.

Anna is a Tutor at The Career Academy and has a strong background in hands-on accounting and bookkeeping after several years working in this area. One of her favourite quotes is, “Education is the difference between wishing you could help other people and being able to help them”- Russell M Nelson. Anna feels that education is the foundation of growth, and she is committed to helping students, whatever their abilities, achieve their learning goals.

Anna graduated from Auckland University of Technology with a Bachelors in Business, majoring in Accounting & International Business, and she enjoys using her experience, together with her passion for learning, to be a positive influence on our students.

When Anna isn’t helping students, you can find her with her family and in her garden.

Md brings over 10 years of diverse experience spanning aviation, HR, retail, and education to the world of finance and accounting. With notable positions at esteemed organizations such as Biman Bangladesh Airlines, Impact College, and Tech Mahindra, he has honed his expertise.

Md holds MBA degrees from both the University of Chester and the University of Dhaka, enabling him to take a strategic approach to teaching accounting and finance concepts. His proficiency in financial analysis and forecasting ensures that he delivers dynamic and practical lessons.

Prior to his role at The Career Academy, Md served as the Financial Accounts Manager at Impact College, where he oversaw critical functions like internal audits and budgeting. He integrates this hands-on experience into his tutoring, bridging the gap between theory and real-world scenarios.

As a mentor, Md guides students through intricate topics such as bookkeeping processes, VAT compliance, payroll management, financial,and management reporting, guaranteeing comprehensive learning. His systematic teaching style and exceptional communication skills make complex financial subjects more accessible.

Driven by his passion for inspiring students, Md promises an enriching and value-driven learning journey. With his multifaceted expertise, he offers well-rounded support to learners.

I obtained a Bachelor of Business Studies majoring in Accounting from Waikato Institute of Technology. During my time studying, I mentored several international students in a range of topics including commercial law, marketing, accounting & finance. Not only did this give me lots of energy watching my students grow, it also deepened my understanding of these topics as well as how to relate to people.

It is no surprise that I came to The Career Academy – with a teacher for a mother, it’s just in my blood.

Outside of work, I like to relax by playing football with my teenage sons, dance to Baila music, read, or cook delicious meals with my wife.

Dedicated professional with a passion for continuous learning and adaptability. Excels in leveraging diverse skills to tackle challenges and contribute to collaborative team environments. Committed to achieving goals and driving success through innovation and effective communication.

Be awarded with an industry recognised certificate

Upon successful completion of your course, you’ll be presented with a Professional Certificate by The Career Academy. This an industry recognised certificate which will go a long way to helping you get a new job or promotion. You’ll also be given access to our exclusive Career Centre and be eligible for a free CV Review.

Opportunities

Career Opportunities

The Career Academy’s bookkeeping program not only equips you for a dynamic career in finance but also sees many graduates successfully launching their own bookkeeping businesses. Our comprehensive training ensures you’re ready to excel, whether by starting your venture or joining the workforce in small to medium-sized businesses. As a graduate, you’ll find yourself well-prepared for roles such as:

- Tax Agent

- Bookkeeper

- Payroll Officer

- Financial Advisor

- Assistant Accountant

Career Projections

The demand for accounts officers and bookkeepers is on the rise, driven by a steady growth in business services which is expected to be the fastest-growing segment in the job market. This growth is projected to lead to:

- A notable increase in Bookkeeping and Accounts-related roles continuing through to 2026.

- Key industries employing bookkeepers encompass professional services, scientific and technical services, construction, as well as education and training sectors.

Sources: Careers New Zealand

The Career Centre

The Career Academy is committed to helping you on your pathway to success. We believe by utilising The Career Centre’s resources and connections, you’ll gain confidence and the networks you need to get a new job or promotion.

Once enrolled with us, you will get instant access to our Career Centre and benefit from:

- Access to CV Templates – freshen your current CV with one of our professional templates

- A free personalised CV review – we’ll review and provide feedback on your CV to ensure it stands out from the crowd

- Useful job tips and resources – we’ll outline a clear five step job success process for you to follow

- Help getting ready for interviews – will give you tips & tricks on how to succeed

HIROMI FINDS THE BEST OF BOTH WORLDS

Despite being an Auckland girl through and through, she spent a short stint in Rarotonga before starting school, and lived in London for a couple of years teaching and nannying.

“After having a couple of kids of my own, I decided I wanted a career change and had a general interest in Bookkeeping”

Hiromi says. So, she decided to switch her career from helping raise kids to helping raise revenue with The Career Academy’s Certificate in Bookkeeping.

For Hiromi, the flexibility of study at The Career Academy made all of the difference. “I liked being able to do the entire course at home, my daughter was only 10 weeks at the time, so I appreciated having the flexibility to study within my own pace. I could choose which days I wanted to commit to study – so I was able to balance study with my personal life.” Studying when, where and how she liked meant that Hiromi didn’t have to choose between the life she had and the life she wanted to achieve for herself.

And once Hiromi reach the end of her course – her hard work paid off! She took advantage of The Career Academy’s Career Centre, a service built to help students find their dream role after graduating. She spotted a bookkeeping role with The Back Office Company, applied for it, and got the job!

“I am really enjoying the challenge of something new.” Hiromi says of her new position as a bookkeeper. “I am able to establish a new career around the kids and it fits in really well with family life. A new challenge is always good! I really appreciate the support from The Back Office Company – they have really helped me progress into this role and without the support it wouldn’t be possible for me to do this role.”

Hiromi is taking the first steps in her new career – and you can too. The Certificate in Bookkeeping will let you become a certified bookkeeper in just 10 weeks, putting you on the path to work as a bookkeeper, or start your own bookkeeping business. You’ll also get access to the MYOB partner program, and get six months free access to MYOB, and receive the Official Xero Advisor Certification on completion.

Get all the info you need

- Course duration, qualifications and module details

- Pricing and payment options

- Compare other related courses

- Receive a free course consultation

Prefer a call? Talk to our friendly staff on 0800 342 829

Frequently

Asked

Questions

There are no entry requirements or prerequisites to enrol on this course. You can enrol online directly by clicking on “Enrol Now” and following the prompts. Alternatively, you can enrol over the phone with our friendly student advisors – call 0800 342 829 or email them at info@careeracademy.co.nz

This course costs $2,450.00 + GST or only $25 per week on a no-deposit, interest-free payment plan. Click here to get started now.

Yes, you can apply for RPL for this if you already hold other accounting qualifications or have other accounting experience.

This course takes approximately 400 hours, and you’ll have up to 18 months to complete. While you can study in your own time, at your own pace, you should allocate up to 6 months for the Certificate and 12 months for the Diploma.

Most of The Career Academy courses are designed so that you do one module a week, but if life gets busy, you can apply for a course extension if you need more time.

Upon completing this course, you could obtain work as an Accounting Technician, Bookkeeper, Office Administrator, Financial Controller or Payroll Administrator.

Contact a friendly student advisor on 0800 342 829 to learn about potential career outcomes and where our courses could take you. Employers often approach The Career Academy looking for students and advertise jobs in our Career Centre, which you can access once enrolled. You’ll also receive a FREE CV review.

Your course is delivered through our online learning platform, which you can access from any web browser 24/7 to work whenever and wherever you want. You can also interact with your tutors and other students within the learning environment. Online learning allows you to make the best use of your time and puts all the necessary resources at your fingertips. There are no set course start dates; you can start whenever you are ready, and your tutors and student services will check in on your progress and help you every step of the way.

Watch this video to see how online learning works:

Absolutely! You’ve got a 7 day cooling off period (or trial period) at the start of your course. Take that time to look through all your learning material and get a feel for online learning. If you decide the course isn’t for you within the trial period, you’ll get a full money back guarantee*.

Yes, with further study. You can apply the foundation knowledge you acquire with our Accounting Technician Pathway for Bookkeepers to study towards becoming a Chartered Accountant (CA). To become a Chartered Accountant, you must complete a degree, several CA programs, and three years of mentored practical experience.

Absolutely! Students who have complete this Program, including the CAT certification component with IPA, will also be eligible for 3 exemptions from the ACCA Qualification:

- Business & Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)